Paying with a credit card allows you to purchase items and services without having to use cash. When you use your credit card, your credit card issuer will pay the merchant on your behalf and bill you later in the form of a monthly statement. There are dozens of types of credit card, distributed among dozens of credit card issuers. To make the right choice, in order to get your first credit card, you should understand the type of card based on your real needs. Starting from the “no-frills” basic cards (known as “Plain-Vanilla“), we will guide you through the main types of credit cards, up to your premium one with lots of advantages and benefits.

Standard “Plain-Vanilla” Credit Cards

Standard credit cards are referred to as “plain-vanilla” credit cards, because they don’t offer any frills, rewards. They’re very easy to use. This is perfect for you, if you just want a card that isn’t complicated and you’re not interested in earning rewards. The perks of plain vanilla cards are basically the same from one financial institution to the next, while the card’s credit limit also depends on the cardholder’s creditworthiness. It allows you to have a revolving balance up to a certain credit limit. Credit is used up when you make a purchase and then more credit is made available once you’ve made a payment.

Balance Transfer Credit Cards

While many credit cards come with the ability to transfer balances, a Balance transfer credit card is one that offers a low introductory rate on balance transfers for a certain period of time. So, if you need to save money on a high-interest rate balance on an existing card, a balance transfer is a good way to go. Balance transfer interest rates vary — some are as low as 0 percent, but these usually have qualifiers such as a minimum of two transactions a month.

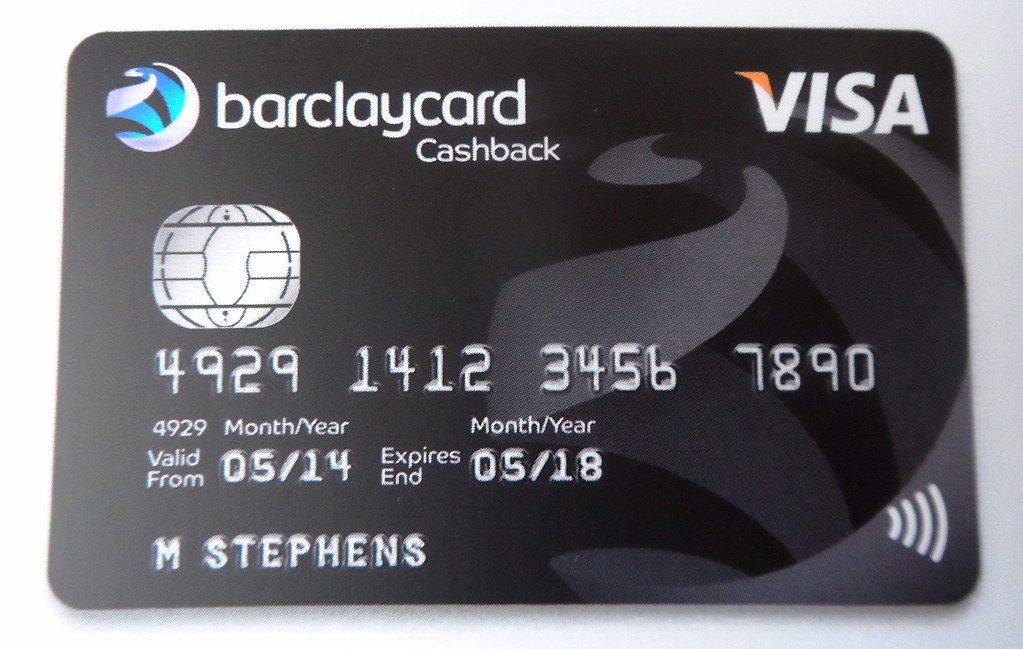

Rewards Credit Cards

Basically, rewards cards offer rewards on credit card purchases. Some people prefer the flexibility of Cashback rewards, while others like Points rewards, that can be redeemed for cash or other merchandise. Cashback credit cards are popular because they provide tangible, easy-to-understand benefits. Who doesn’t like getting a credit on their monthly credit card statement – or, better yet, actual cash deposited into the account of their choice? Travel rewards cards remain a favorite among frequent travelers, because of the ability to earn free flights, hotel stays, and other travel perks.

Student Credit Cards

Student credit cards are those specifically designed for college students with the understanding that these young adults often have little or no credit history. A first-time credit card applicant would generally have an easier time getting approved for a student credit card than another type of credit card. Student credit cards may come with additional perks like rewards or a low-interest rate on balance transfers, but these aren’t the most important features for students looking for their first credit card. Students generally must be enrolled at an accredited four-year university to be approved for a student credit card. Here, some of the best student credit cards on the market today: Deserve EDU Student Credit Card, The Petal Cash Back Visa Card, Journey Student Rewards from Capital One, Citi Rewards+ Student Card, Capital One Secured Mastercard.

Charge Cards

Charge cards don’t have a preset spending limit and balances must be paid at the end of each month, in full. Charge cards don’t have a finance charge or minimum payment, because the balance needs to be paid in full. Late payments are subject to a fee, charge restrictions, or card cancellation depending on your card agreement. You typically need to have a good credit history in order to qualify for a charge card. Examples of charge cards are American Express, Diners Club International, HSBC Amanah Mastercard,

Secured Credit Cards

Secured credit cards are an option for people who don’t have a credit history or who have damaged their credit status. Secured cards require a security deposit to be placed on the card. The credit limit on a secured credit card is typically equal to the amount of the deposit made on the card, but it could be more in some cases — such as defaulting on a mortgage payment. It’s worth noting that you’re still expected to make monthly payments on your secured credit card balance.

Subprime Credit Cards

Subprime credit cards are one of the worst credit card products. These credit cards are geared toward applicants who have a bad credit history and these cards typically have high interest rates and fees. While approval is often quick, even for those with bad credit, the terms are often confusing. The Federal government has made rules regarding the amount of fees subprime credit card issuers can charge, but the card issuers often look for loopholes and ways to skirt these rules. Despite the unattractiveness of subprime credit cards, some consumers continue to apply for the cards because they cannot get credit elsewhere. This is a situation where you have to proceed at your own risk.

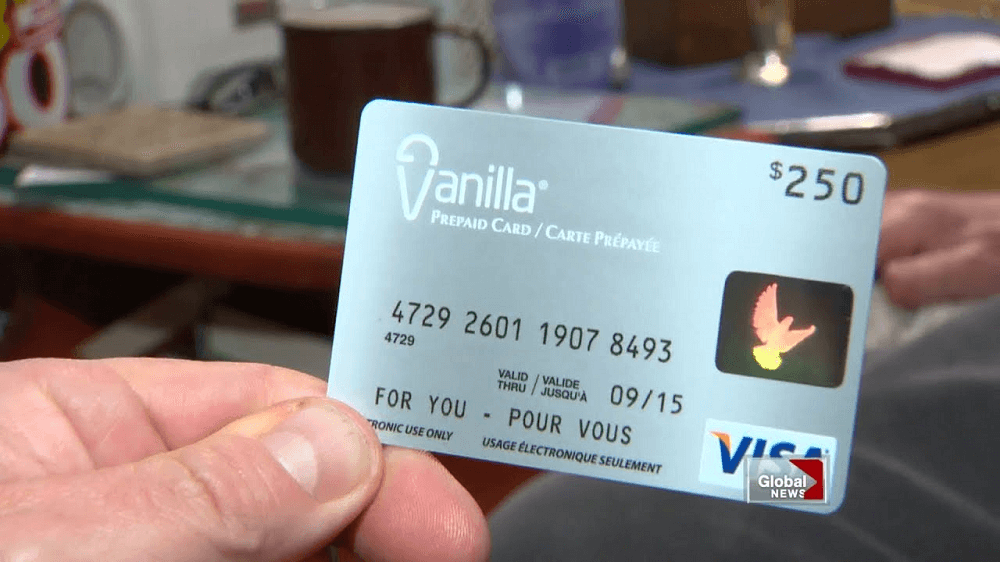

Prepaid Cards

Prepaid cards require the cardholder to load money onto the card before the card can be used. Purchases are withdrawn from the card’s balance. The spending limit does not renew until more money is loaded onto the card. Prepaid cards do not have finance charges or minimum payments because the balance is withdrawn from the deposit you’ve made. These cards are not actually credit cards, and they don’t directly help you rebuild your credit score. Prepaid cards are similar to debit cards, but are not tied to a checking account. A lot of people use them as a way to stay within budget.

Limited Purpose Cards

Limited purpose credit cards can only be used at specific locations. Limited purpose cards are used like credit cards with a minimum payment and finance charge. Store credit cards and gas credit cards are examples of limited purpose credit cards.

Business Credit Cards

Business credit cards are designed specifically for business use. They provide business owners with an easy method of keeping business and personal transactions separate. There are standard business credit and charge cards available. Even for a business credit card, your personal credit history is considered because the credit card issuer still needs to hold an individual accountable for the credit card balance.

You may also like

Car valuation in 2023: Tools and rules to get the most out of the sale

In 2023, the valuation of a car relies on modern tools and specific rules to get the most out of the sale. Today, values are established using online valuation systems, such as specialised websites and apps, which take into account various factors such as the model, year of production, mileage and general condition of the… Continue reading Car valuation in 2023: Tools and rules to get the most out of the sale

The latest news on pet insurance

In 2023/2024, pet insurance offers significant benefits for the care and protection of dogs and cats. These policies provide coverage for veterinary expenses, medical emergencies and other health needs of our four-legged friends. Coverage under pet insurance policies includes routine veterinary visits, treatments for illnesses and injuries, surgeries and therapies. Some policies may also cover… Continue reading The latest news on pet insurance

Online bank accounts in the US: latest news

In 2023/2024, online bank accounts in the United States offer a host of benefits and new features. These accounts allow you to manage your finances conveniently, quickly and efficiently, without having to visit a physical branch. Online bank accounts offer digital banking solutions, allowing users to bank from anywhere, at any time. One can make… Continue reading Online bank accounts in the US: latest news

Home Insurance in the US, the latest guide 2023

In 2023/2024, home insurance in the United States offers significant benefits to protect flats and villas. These policies provide cover against physical damage, theft, liability and other unforeseen situations that may occur in one’s home. Coverages provided by home insurance policies include damage caused by fire, flooding, storms, theft and vandalism. Some policies may also… Continue reading Home Insurance in the US, the latest guide 2023